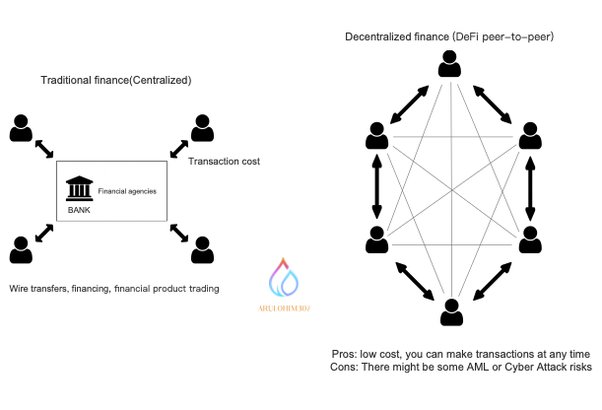

There are plenty of DeFi protocols and applications already. Here are the differences between traditional financial services and DeFi:

Dai and Maker protocol in MakerDAO, Aave protocol, Uniswap protocol, dYdX, Chainlink.

# MakerDAO

- What is the MakerDAO protocol?

MakerDAO is an open-source project on the Ethereum blockchain which means decentralized autonomous organization. The Maker protocol consists of two types of tokens.

First, the token Dai, which I introduced before, is a multi-collateral backed stablecoin Dai designed for stability purposes. It supports 16 cryptocurrencies, including ETH, USDC, GUSC, WBTC, etc. Second, the governance token MKR is designed for stakeholders. The MKR is used to maintain the ecosystem and manage Dai. There is a scientific governance system designed to help the governance process. Two supported functions include Voting and Governance Polling. If an MKR owner wants to participate in the Governance process, they need to send their MKR token to the voting contract for validation. One MKR token represents one vote.

In my opinion, The Maker Protocol is the first significantly adopted Defi application.

# MakerDAO | An Unbiased Global Financial System

MakerDAO enables the generation of Dai, the world’s first unbiased currency and leading decentralized stablecoin.https://makerdao.com/en/

# Aave – non – custodial liquidity protocol

- What is the Aave protocol?

Aave protocol is not a Peer-to-Peer lending strategy but a pool-based strategy. You may ask, what is the difference between these two?

For the P2P lending strategy, every lending needs two parties to become a match: lenders and borrowers. Instead, the protocol pools funds together for the pool-based strategy, the same as the amounts borrowed and their collateral. This mechanism enables FlashLoan property.

- What can we do with FlashLoan?

Flash loans are uncollateralized loans in DeFi. Liquidity is returned within one transaction block, and there is no collateral needed. The flash loans are designed for experienced developers. They need to build a contract to request a flash loan, then the contract itself will have all other steps, for example, payback to the loan, interest, and charges within one transaction block.

Functionalities:

Refinance, collateral swap, arbitrage and liquidate, and others as well.

# Aave – Open Source Liquidity Protocol

Aave is an Open Source Protocol to create Non-Custodial Liquidity Markets to earn interest on supplying and borrowing assets with a variable or stable interest rate. The protocol is designed for easy integration into your products and services.https://aave.com/

There are other DeFi applications as well.

Such as Uniswap protocol, which is a decentralized crypto trading protocol.

Chainlink, a decentralized oracle network, provides tamper-proof inputs, outputs, and computations. The purpose is to support advanced smart contracts on any blockchain.

Decentralized Finance has experienced tremendous growth since mid-2020. Still, DeFi has shown that offering decentralized financial services at scale is possible in its early days. However, we need to consider governance, security, tax, and regulatory areas in the DeFi ecosystem. DeFi will reshape the future of Finance in long-term expansion.