UTILIZE STABLECOIN PAYMENTS USING USDC, USDT, DAI.

1) There are four types of stablecoins

2) Stablecoin benefits

3) Well, here are some stablecoin use cases

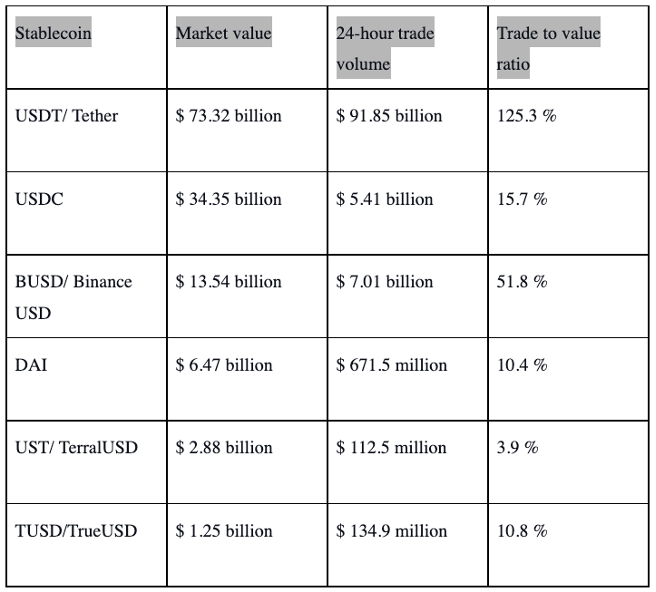

Stablecoins are the type of cryptocurrencies often expressed in US dollars. They are pegged 1:1 with US dollars.

There are four types of stablecoins

1. Fiat-collateralized stablecoins

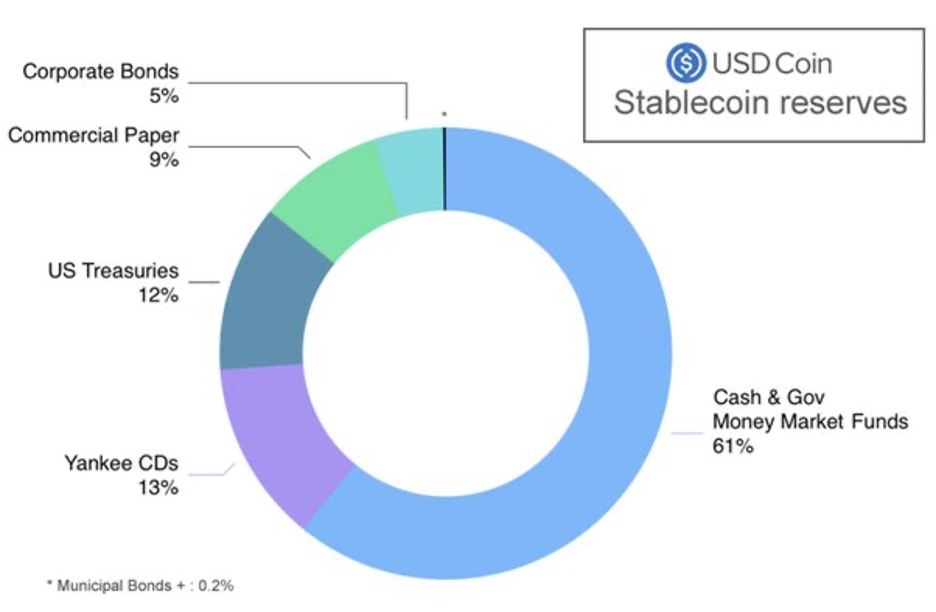

It’s the most common stablecoin, this kind of stablecoin is backed by fiat money such as USD with a 1:1 ratio of fiat money. USDC and USDT are fiat-collateralized stablecoins. USDC issuer Circle claims that each USDC is backed by a dollar held in reserve. If someone wants to invest 1 million USDC, Circle must make sure 1 million dollars are deposited in the bank before stablecoin minting.

2. Crypto-collateralized stablecoins

This type of stablecoin is backed by other cryptocurrencies. It’s more volatile than other stablecoins due to the volatile nature of cryptocurrencies. The most famous example is DAI, issued by MakerDAO.

3. Commodity-collateralized stablecoins

This type of stablecoin is backed by reserved commodity assets other than fiat currencies: real estate, gold, and various precious metals.

i.e., Tether Gold (XAUT) and Paxos Gold (PAXG) are commodity-collateralized, gold-backed stablecoins.

4. Non-collateralized stablecoins

This type is known as algorithmic stablecoins. It is a non-backed stablecoin in which human-designed algorithms control prices and token numbers. The strategy is to maintain demand and supply curves, reducing the event of price fluctuations.

the famous stablecoin that was recently crashed TerraUSD (UST).

# Stablecoin benefits

1. Price is stable

stablecoins are widely accepted by cryptocurrency exchanges since the price is stable and predictable. They can facilitate seamless transactions and bridge from fiat to cryptocurrency use.

More and more businesses have started to accept cryptocurrency, and stablecoin is one of the best options.

2. Fiat-backed stablecoins are regulated

Fiat-backed stablecoin is fully reserved, such as USDC, cash, and short-duration US treasuries back it. Some may say cryptocurrencies are pure bubbles. Some altcoins might be the case, but not fat-backed stablecoins.

Traditional payment methods such as credit cards, wire transfers, and third-party payment providers average about 2% per transaction. These costs can be circumvented using stablecoins, so businesses and customers can benefit through the use of stablecoins.

4. faster

stablecoin settlement and banking travel much faster than banks or services through various financial institutions. Traditional payments may take days or weeks to process a transaction, but stablecoin only takes minutes on the blockchain.

How can you utilize stablecoin payments?

# Well, here are some stablecoin use cases

Payments

Payments have been one of the primary use cases in recent years. Businesses can reduce 2-3% the transaction fees charged by financial institutions. For example, Walmart has unveiled a patent for its stablecoin.

Remittance

stablecoin is also valuable for cross-border payments and Remittances. Cross-border payments can be costly and painful in some countries. There are a lot of places that only have underdeveloped financial agencies. Overseas workers often have trouble when trying to send money home. Using stablecoin can significantly reduce transaction costs and shorten funds settlement time meanwhile maintain the price stability of their hard work.

Interest earning

You deposit your stablecoins to a trusted third-party company. This company can make loans to other parties. Like the traditional banking system, customers deposit their money, and banks use it to make investments or loans. Then customers get the interest return plus money back at the end of the agreed period. Make sure you choose a company that is fully audited and compliant. Otherwise, you might lose all your hope. The annual return rate could be as high as 12%, not bad. Enjoy your compound interest investments!

Lending

This method is similar to the first one, but with all risks on your side. The Compound Protocol is what you are looking for. As an investor, you can borrow and lend any cryptocurrency in the short term. This protocol runs on Ethereum. You will be looking for the highest APY, which regularly represents the annual percentage yield in the liquidity pool.

When users and Dapps supply an asset to the Compound Protocol, it starts to make interest on every Ethereum block. Even non-technical users can use this protocol using interfaces like Argent.

It happens mainly on a POS proof of stake consensus mechanism. The idea behind this is compound interest in finance as well. Users deposit their cryptocurrency in a platform for a lock-up. They get a stake in various forms, including mining rewards and voting rights. Ethereum is “upgrading” from POW to POS via Eth2 upgrades. POS helps to activate validators upon receipt of enough stake. Unfortunately, users need 32 ETH to become a validator, which is $147933, an insane amount. You can use DAI, USDC, or deposit your stablecoins to Defi. You always need market makers to keep the system liquid.

limitations of stable coin

- It requires trust from an entity or a third party. In other words, stablecoins may become worthless when the company goes bankrupt.

- It must require trusted external audits to ensure assets are accounted for.

Ricky

Growth Strategist at AurpayAs a growth strategist at Aurpay, Ricky is dedicated to removing the friction between traditional commerce and blockchain technology. He helps merchants navigate the complex landscape of Web3 payments, ensuring seamless compliance while executing high-impact marketing campaigns. Beyond his core responsibilities, he is a relentless experimenter, constantly testing new growth tactics and tweaking product UX to maximize conversion rates and user satisfaction